Accra, Day 2: Six Facts & ‘Sticky’ Questions

Tuesday May 8 2017.

Today we all exchanged our stories of our “home dinners” last evening, which was a lively, laughter-filled discussion with once again many similarities in experience. Every group said that they felt like they “could talk forever,” and were 'just like old friends.' Like my experience, conversations ranged from all topics from work to family to dating life to money and wealth to politics and everything in between.

We then began to dive into women finance, Access Bank, and most excitingly, the 4 businesses we are here to engage with. There are 20 of us, in three groups: the “internationals,” (those of us from the US and Europe, representing a range of financial institutions), the Access Bank Ghana Women’s Banking program representatives, and the local women entrepreneurs. The four business owners are:

- Emelia, who hosted us last night, and runs a packaging company which is a subsidiary of an integrated family business operating in Ghana

- Helena who is running a consumer goods company, importing and distributing various goods from food to personal care across markets

- Joanna who runs a utility business in Ghana

- Gladys who is operating a car battery business, doing well in a male-dominated field, especially when she teaches a man how to take care of his car battery

Six Facts.

To set the stage for understanding these businesses, one of the program sponsors, my friend, partner & colleague Chantal, shared six *facts* about women finance:

(Many of these are well-known, well-researched, and increasingly much-discussed, in both emerging and developed markets contexts. These are not casual observations, or proclamations. These are backed by research, and were shared so that they could serve to ground our thinking about women entrepreneurs, economic empowerment and equality, and finance in general.)

- Women are better borrowers than men. They default less than their male counterparts.

- Women make different decisions than men. They often take longer than man, but that is because they consider both the pro & the contra, and thus tend to make more balanced decisions.

- When a woman is satisfied with her experience at a bank, she will share this with her entire network. She is loyal and brings others along with her.

- Also when a woman is satisfied, she will buy more products. This means that women have a higher cross-sell ratio than men.

- When a woman takes out a loan, it is for her family, her community, and her country. It’s not just for her.

- There is a positive correlation between company ROE & women on the board.

Sticky Questions.

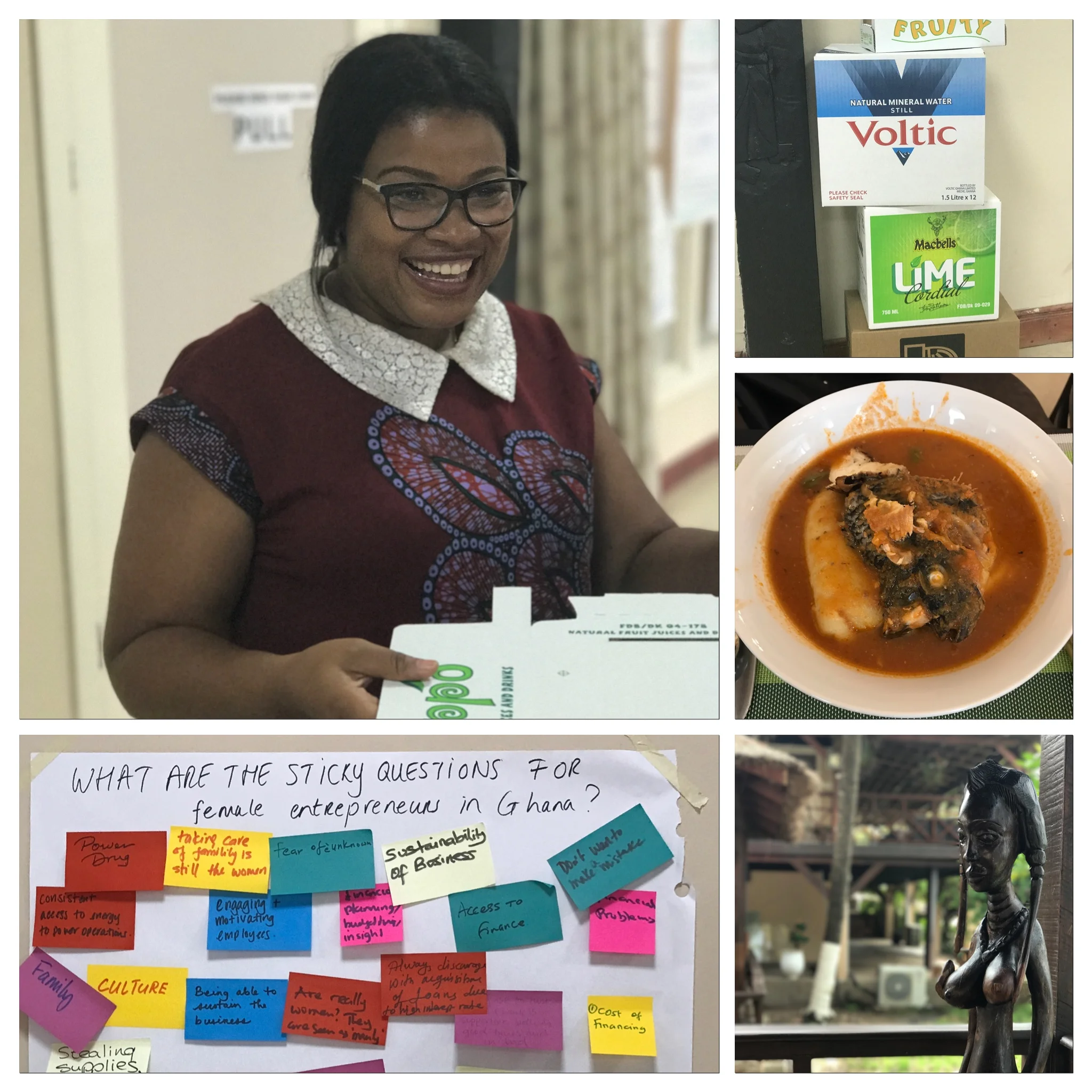

We “boarded” sticky notes with answers to “what are the sticky questions?” for our groups, entrepreneurs, access bank Ghana, and internationals. Some that struck me were....

- balancing career and family

- access to finance

- competition

- self-criticism

- collateral

- risk-taking

- culture

- sustainability

Lunch was also a learning experience and a new adventure. Today I tried a local treat similar to banku, that is also made with cassava, but with cassava and plantain (instead of corn). Fufu is served most commonly with soup, usually soup with fish in it. It is also eaten with your hands, using your first two fingers almost like chopsticks and scooping the soup with the bit of fufu. Of course, I did it all wrong initially, chewing the fufu with a bit of fish at the same time. It is eaten almost slurped, not chewed, and just swallowed. The fish is eaten with the hands, separately. It is VERY filling and has a similar almost paste-like consistency. Emelia, Gladys and Raheemat explained that many people have this every day and ‘can’t go without their fufu!’. Having rice with a meal is often believed to be not enough, for example, it is an appetizer or even a dessert for the fufu main meal. A beautiful meal!

Another incredible day of learning, observing, engaging and connecting with women from so many different backgrounds and perspectives. I am so excited to dig in further on Emelia’s business, her growth plan, her pitch, and her capital plans! Tomorrow we really deep dive on the business, do site visits, and strategize for Thursday’s Pitch Panel!

With enthusiasm,

Maggie